South West Arkansas Project

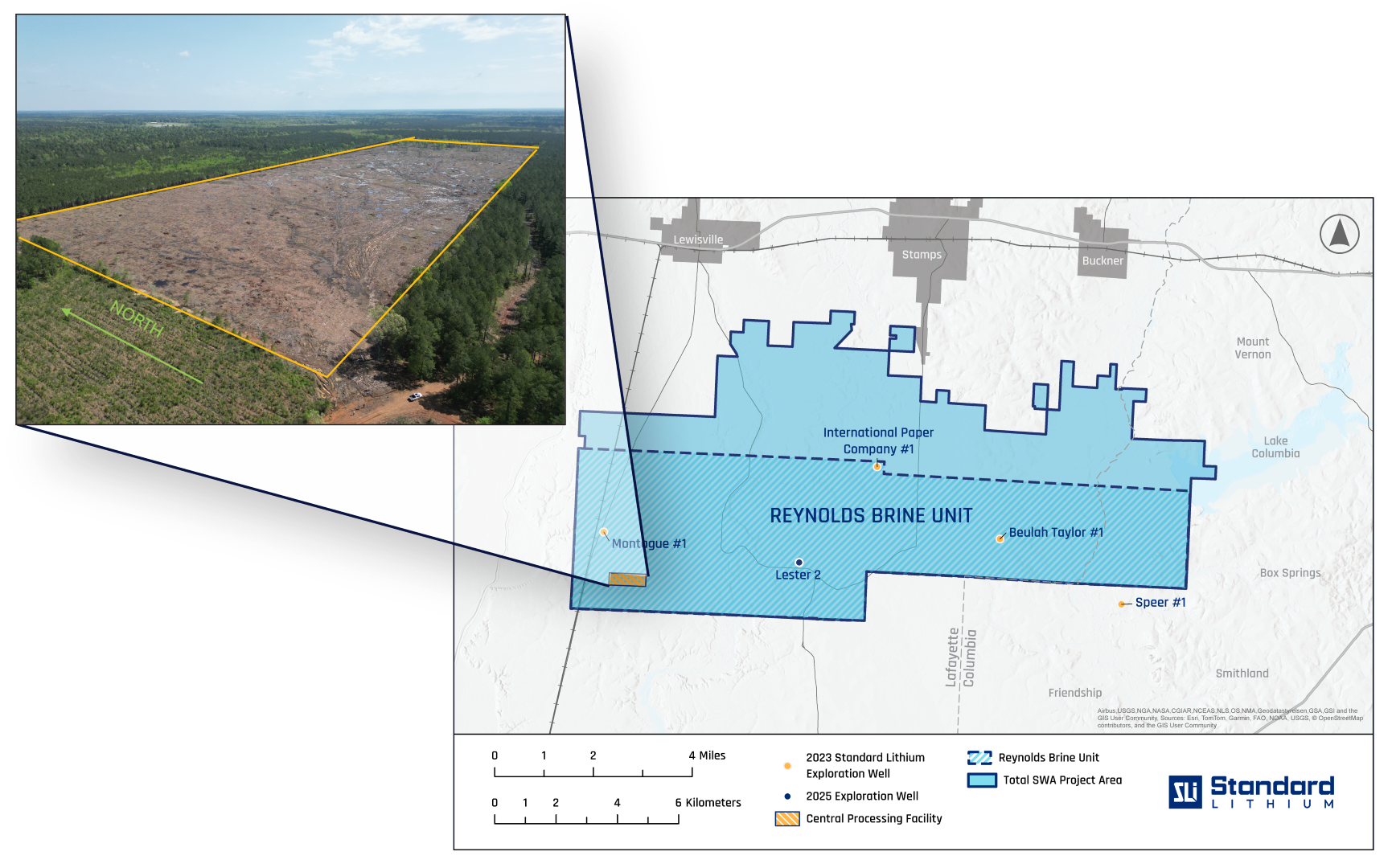

The South West Arkansas Project (“SWA Project”) located in southern Arkansas near the Texas and Louisiana borders, is the flagship project of Smackover Lithium, a Joint Venture (the JV) between Standard Lithium (55%) and Equinor (45%). The Project is located approximately 15 miles (24 kilometers) west of Magnolia in Columbia County and 7 miles (11 kilometers) south of Lewisville in Lafayette County.

The SWA Project encompasses approximately 30,000 acres of brine leases in the region, with the initial phase of project development focused on production from the Reynolds Brine Unit. The Reynolds Brine Unit is 20,854 acres and was unanimously approved by the Arkansas Oil and Gas Commission (“AOGC”) to "and without objections from stakeholders or the local community. (press release dated April 24, 2025)

The initial phase of development contemplates production of battery-quality lithium carbonate at annual production capacity of 22,500 tonnes with the non-unitized leases in the area providing significant opportunity for future expansion.

Front-end engineering design (“FEED”) was completed in support of a Definitive Feasibility Study (DFS) (press release dated September 3, 2025) with a principal recommendation that the Project is ready to progress to a Final Investment Decision (“FID”). Construction is expected to commence in 2026 shortly after FID, with first production targeted in 2028.

Definitive Feasibility Study Highlights

- First production targeted in 2028. Projected initial production capacity of 22,500 tonnes per annum (“tpa”) of battery-quality lithium carbonate (“Li2CO3”) for the Project, marking the first commercial lithium production in the Smackover Formation.

- 20-year plus operating life. Detailed Resource and Reserve modelling supports a production plan with average lithium concentration of 481 mg/L, underpinning a minimum 20-year operating life with ample opportunity for significant further expansion.

- Robust project economics. Unlevered pre-tax NPV of $1.7 billion and IRR of 20.2%, assuming a discount rate of 8% and a lithium carbonate price of $22,400/t (average of Fastmarket’s 20-year forward pricing curve for battery-quality lithium carbonate).

- Competitive OPEX. Average cash operating costs of $4,516/t over the operating life and average all-in costs of $5,924/t.

- Total CAPEX of $1.45 billion. All-in Class III capex estimate of $1.45 billion includes a 12.3% Monte Carlo risked contingency. This is informed by an 18-month detailed front-end engineering design (“FEED”) process which has yielded capital definition well beyond typical DFS studies. Conservative adoption of pilot and demonstration plant learnings used in FEED results in improved capital intensity expected on future expansion phases.

- Increased exploration activities support better Resource definition. Since completion of the Prefeasibility Study (“PFS”), the JV has re-entered wells and drilled a new in-fill well to support upgrading the Resource and modeling Proven and Probable Reserves. The Total Measured and Indicated Resource is 1,177,000 tonnes lithium carbonate equivalent (“LCE”) at an average concentration of 442 mg/L for 0.50km3 of brine volume, and Proven Reserves are 447,000 tonnes LCE at an average concentration of 481 mg/L for 0.20km3 of brine volume.

- First commercial Direct Lithium Extraction (“DLE”) in United States. Smackover Lithium is licensing Aquatech’s (formerly Koch Technology Solutions’) Lithium Selective Sorption (“LSS”) process for the initial phase of the Project, which includes performance guarantees. Opportunity exists for further operational and cost improvement on future expansion phases with regional exclusivity for the technology in the Smackover under a joint development agreement (the “Joint Development Agreement”).

| Annual Production Capacity of Li2CO3 | tpa[1] | 22,500[2] |

| Modeled Plant Operating Life | years | 20[2] |

| Brine Flowrate at Start of Production | bbl/d[3] | 148,000 |

| Average Brine Flowrate over Modeled Plant Operating Life | bbl/d[3] | 168,000 |

| Lithium Grade at Start of Production | mg/L | 549 |

| Average Lithium Grade over Plant Operating Life | mg/L | 481 |

| Total CAPEX | $ millions | 1,449[4,5] |

| Average Annual Cash OPEX | $/t | 4,516 |

| Average Annual All-in OPEX | $/t | 5,924[6,7] |

| Selling Price | $/t | 22,400[8] |

| Discount Rate | % | 8.0 |

| Net Present Value (NPV) Pre-Tax | $ millions | 1,666 |

| Net Present Value (NPV) After-Tax | $ millions | 1,275[9] |

| Internal Rate of Return (IRR) Pre-Tax | % | 20.2 |

| Internal Rate of Return (IRR) After-Tax | % | 18.2[9] |

Notes:

All model outputs are expressed on a 100% ownership basis with no adjustments for project financing assumptions. Standard Lithium’s economic interest in the Project is 55%. Any discrepancies in the totals are due to rounding effects.

[1] Tonnes (1,000 kg) per annum.

[2] Plant design and financial modelling based on 20-year economic life. Proven and Probable Reserves together support a 40-year operating life.

[3] Barrels per day. 1 cubic meter per hour = 151 barrels per day.

[4] Capital Expenditures include 12.3% contingency determined with Monte Carlo Risk analysis.

[5] No inflation or escalation factor has been applied for the economic modelling.

[6] Includes operating expenditures, royalties, sustaining capital and closure costs.

[7] Royalties include quarterly gross lithium royalty of 2.5% as approved by the Arkansas Oil and Gas Commission (“AOGC”), an additional brine fee of $65/acre per year and override fees payable on certain optioned brine leases.

[8] Selling price of battery-quality lithium carbonate based on a flat assumed price of $22,400/t over total Project lifetime. Represents average of 20-year forward pricing curve provided by Fastmarkets for battery-quality lithium carbonate, commencing in 2028.

[9] Illustrative after-tax calculations based on assumption that SWA Lithium, LLC is taxed as a stand-alone US C-Corporation, and does not include the potential impact of currently held corporate net operating losses or credits, nor potential tax shields generated from financing. Assumes a U.S. Federal income tax rate of 21%, a State of Arkansas income tax rate of 3.4%, and includes the impact of ad valorem and other local taxes.

Measured, Indicated and Inferred Resource Estimation[1,2,3,4,5,6,7]

| Resource Category | Measured | Indicated | Measured and Indicated |

| Project Area | Reynolds Brine Unit | Potential Expansion Area | Total |

| Upper Smackover | |||

| Gross Aquifer Volume, km3 [8] | 4.33 | 2.12 | 6.45 |

| Net Aquifer Volume, km3 [8] | 2.86 | 1.39 | 4.25 |

| Average Porosity | 11.80% | 11.75% | 11.79% |

| Brine Volume, km3 [8,9,10] | 0.34 | 0.16 | 0.50 |

| Average Lithium Concentration, mg/L | 514 | 293 | 442 |

| Lithium Resource, thousand tonnes [2] | 173 | 48 | 221 |

| LCE, thousand tonnes [2,11] | 922 | 255 | 1,177 |

| Resource Category | Inferred | ||

| Project Area | Reynolds Brine Unit | Potential Expansion Area | Total |

| Middle Smackover | |||

| Gross Aquifer Volume, km3 [8] | 4.99 | 3.00 | 7.99 |

| Net Aquifer Volume, km3 [8] | 0.96 | 0.61 | 1.57 |

| Average Porosity | 9.05% | 9.88% | 9.37% |

| Brine Volume, km3 [8,10] | 0.09 | 0.06 | 0.15 |

| Average Lithium Concentration, mg/L | 452 | 215 | 355 |

| Lithium Resource, thousand tonnes [2] | 39 | 13 | 52 |

| LCE, thousand tonnes [2,11] | 210 | 68 | 278 |

Notes:

[1] The effective date of the Mineral Resource estimate is September 3, 2025.

[2] Results are presented in-situ. The number of tonnes was rounded to the nearest thousand.Any discrepancies in the totals are due to rounding effects.

[3] The Qualified Persons (as defined below) for the Mineral Resources estimate are Randal M.Brush, PE and Robert Williams, PG, CPG.

[4] Mineral Resources are inclusive of Mineral Reserves.

[5] Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral Reserves are shown in Table 6.

[6] The Mineral Resources estimate follows CIM Definition Standards and the 2019 CIM MRMR Best Practice Guidelines.

[7] The Qualified Person is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or market issues, or any other relevant issue that could materially affect the potential development of Mineral Resources other than those discussed in the Mineral Resources estimate.

[8] Volumes are in-place.

[9] Calculated brine volumes only include Measured and Indicated Mineral Resource volumes

that, when blended from the well field, result in feed above the lithium cut-off grade of 100 mg/L.

[10] Cutoff of 6% porosity.

[11] LCE is calculated using mass of LCE = 5.323 multiplied by mass of lithium metal.

Project Highlights

Strong Federal Government support:

- US$225 million grant from the U.S. Department of Energy’s (“DOE”) Office of Manufacturing & Energy Supply Chains (press release dated January 16, 2025). The grant will support construction of the initial phase of the SWA Project.1

- Selected as one of the first critical mineral production projects to be advanced under Executive Order 14241, Immediate Measures to Increase American Mineral Production. This prestigious designation underscores the project’s strategic importance to national security, economic prosperity, and energy independence (press release dated April 21, 2025).

[1] This material is based upon work supported by the U.S. Department of Energy’s Office of Manufacturing Energy and Supply Chains under award Number DE-MS-0000099. The views expressed herein do not necessarily represent the views of the U.S. Department of Energy or the United States Government.

Derisking Activities:

- A robust regulatory regime supported by proven, long term brine production in Arkansas provides clarity and regulatory certainty to project execution. The Project established a royalty for lithium production within the Reynolds Brine Unit (press release May 29, 2025) to support execution.

- A comprehensive exploration program was completed to delineate the resource, and to understand lithium concentrations and the specific characteristics of the Smackover formation in the project area.

*Drill rig on Lester site located within the Reynolds Brine Unit

- Field Piloting of the selected DLE process validated the current design, demonstrating performance in excess of key performance criteria for SWA Project (press release March 11, 2025). The JV, in partnership with Koch Technology Solutions (now Aquatech), successfully completed these final Direct Lithium Extraction de-risking steps for the SWA project, a critical move towards commercialization. Over a three-month period, the JV and its partners operated an on-site DLE field-pilot plant, where it surpassed key performance criteria and generated large-volume samples of concentrated and purified DLE product to be processed by third-party vendors of lithium carbonate conversion equipment in support of vendor qualification and preparation of offtake samples.

*Field-Pilot DLE Plant

Technical Reports

Definitive Feasibility Study, replacing the Pre-Feasibility Study, filed on October 14th, 2025.